How do I make a payment to my loan?

Interest payments can be collected via ACH and principal payments to your loan can be made via wire transfer.

If you are enrolled in auto-ACH and your Plaid-linked bank account becomes disconnected, we won't be able to initiate debit entries to your bank account for interest payments, which can lead to additional fees, loan default and subsequent collateral liquidation and closure of the loan. You can review your bank account and loan status at any time by signing in to your account.

- Interest payments can be withdrawn from your bank account by Unchained via ACH every 30 days if you opt in to Auto ACH during the loan application or click Change payment method on the loan account page and accept the ACH authorization terms.

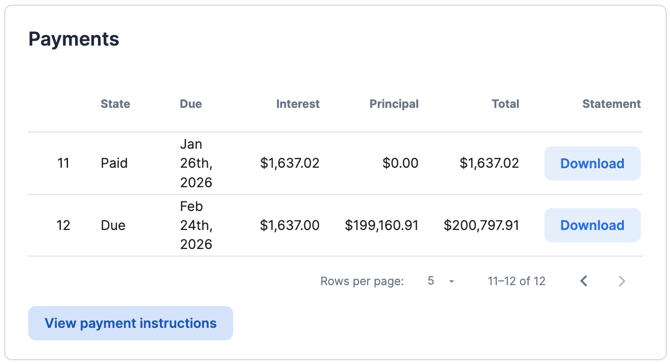

- You can manually send ACH payments to Unchained using the banking details located behind the View payment instructions button on your loan account page.

- Principal payments can be made via wire transfer using the instructions found on your loan behind the View Payment Instructions button. Principal payments reduce future interest payment obligations when applied.

- The bank account titling must match your Unchained commercial account titling to be accepted--mismatches will be rejected.

- The cash balance in your account cannot be used for loan payments.

- The final payment to your loan needs to be sent via wire transfer. You can begin the loan close process at any time by navigating to your loan account page, clicking SHOW MORE, then Loan Close and select the option to settle the payoff amount as well as the corresponding date. There are no prepayment penalties.

Please include your loan ID in the memo field for all wire transfer payments so they may be allocated without delay.